This is the second day of Nestle journey. We look into the Coffee market and Pet Food market related to Nestle’s core items.

3-1. Opportunities

Spreading Home Café Culture

According to 「The analysis Coffee shop status and Market condition of Korea」 published by KB Financial Group Research Institute in 2019, one Korean adult consumed 353 cups per year in 2018, which is 3 times of 132 cups, the annual consumption per capita in the world.

Furthermore, the demand to enjoy a variety of one’s own coffees conveniently in the home café where tools for making coffee set up has increased. In the survey of 「The percentage of coffee drinking by place」 by Macromill Embrain(a research firm, formerly Embrain Trend Monitor), 30.9% of 1,000 respondents answered that they “drinks coffee at home”, showing the highest response rate.

This phenomenon could be interpreted as gearing 1 and 2:

- the increase in individual free time caused from the spread of culture pursuing the work-and-life balance,

- the small but certain happiness trend of wanting to enjoy one’s small coffee time at home.

The Growing number of households with companion animals

Have you ever heard of ‘Petfam’? ‘Petfam’ is a compound word of ‘Pet’ and ‘Family’, which means pet lovers who treat their pets like one of their family members.

In this April, the Ministry of Agriculture, Food and Rural Affairs announced that the number of households raising pets in Korea reaches 5.91 million (based on the 22.3 million households nationwide). Compared to the previous year, 800,000 households increased, and the proportion of households having pets increased significantly to 26.4% from 17.4%, compared to 10 years ago.

In addition, 3 out of 10 respondents who don’t have pets responded that they are willing to raise them someday, according to Opensurvey’s 「Companion Animals Trend Report」. Thus, it seems clear that the households with pets will increase in the future gradually.

Regarding the pet care market, Euromonitor estimated the size of Korean pet care market at 1,944 billion won in 2019, increased by 8.5% from 2018. And Euromonitor expected this market to be 2,580 billion won in 2020, an increase of 5.9% compared to 2019. As much as 2 trillion won for the first time this year!

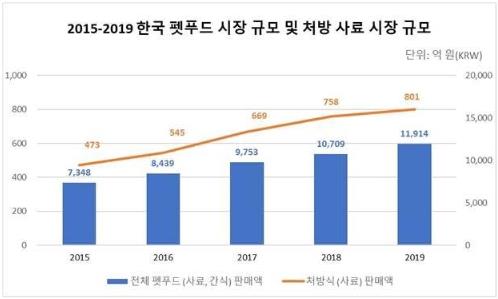

The key driver leading the growth of this market was pet food. The size of Korean pet food market increased 11.3% to 1,191.4 billion won in 2019. And this year, Euromonitor also expected that the pet food market will lead the market growth, by growing 7% from 2019.

3-2. Threats

The decline of the instant coffee market which is a cash cow

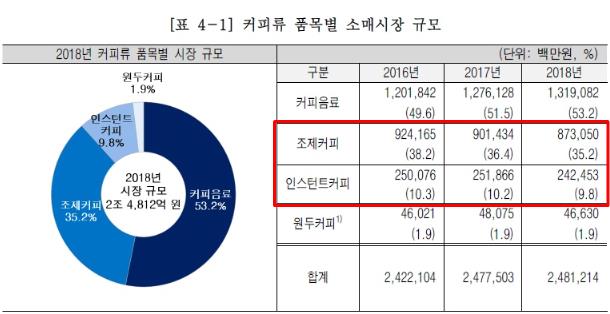

According to the report by Korea Agro-Fisheries & Food Trade and Nielsen Korea, the size of the entire instant coffee market[sum of the completed coffee(the coffeemix + the soluble coffee) and the instant ground coffee] decreased to 1,153.3 billion won in 2017, from 1,412.3 billion won in 2012 (about -18%). What’s worse, the coffee mix market shrank to 91.4 billion won, from 1,238.9 billion won (about -27%) during the same period.

Fortunately, the instant ground coffee(the instant soluble coffee with micro-ground coffee beans) market have rapidly grew to about 252 billion in 2017, it is 5 times compared to 50 billion won in 2012. Thus, traditional coffee companies are moving to invest more in this market to sustain their business.

It is analyzed that consumers have turned their eyes to coffee products that feels more fresh and close to the original taste and flavor of coffee itself as consumers’ tastes have been getting sophisticated and diversified. Therefore, the substitute goods market such as capsule coffee, brewed coffee, RTD coffee, and espresso machine is expected to grow vigorously, as well.

The next article will cover the marketing strategies and activities.

Please stay tuned!